Essential Health Care Coverage and Protection for Employees and Employers in Indianapolis and the surrounding areas.

Top-Rated Employee Benefits Planning in Indianapolis

Navigating the complexities of employee benefits can be a daunting task for any small business owner. At Jackson Health Advisors, we understand the unique challenges you face, and we’re here to help. Led by Beth Jackson, our firm specializes in providing affordable and comprehensive major medical insurance packages that are designed to meet the specific needs of small businesses in Indianapolis.

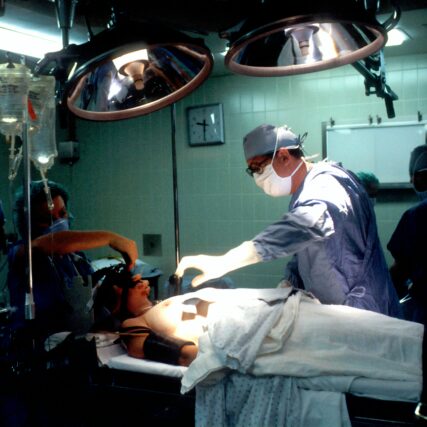

What is Major Medical Insurance?

Major medical insurance is a comprehensive health plan that covers essential medical services, including hospitalizations, surgeries, doctor visits, prescription medications, and preventive care. It provides broad protection against large, unexpected medical expenses, offering peace of mind for both employees and employers.

Peace of Mind

Employees who have major medical insurance experience greater peace of mind, knowing that they’re protected against high medical costs. This security allows them to focus on their work, leading to higher productivity and job satisfaction.

Improved Loyalty & Morale

When employees feel valued and supported, they’re more likely to stay with your company. Providing major medical insurance demonstrates your commitment to their well-being, which can boost morale and reduce turnover.

Why Every Business Should Offer Major Medical Benefits

Talent Acquisition

Offering comprehensive health benefits is a major selling point for prospective employees. In a competitive job market, a strong benefits plan helps attract and retain the best talent.

Employee Health

By providing major medical insurance, employers encourage preventive care and help employees manage chronic conditions, ensuring a healthier workforce (and less unforeseen sick days).

Responsible Practices

Employer-sponsored health coverage is a responsible business practice. Providing major medical insurance reduces the stress and risk of financial ruin for your employees and their families.

Understanding Major Medical Coverage Options

Major medical benefits are not just valuable perks—they’re a critical component of your company’s ability to attract and retain top talent. By offering robust healthcare coverage, you’re not only protecting the health and well-being of your employees, but you’re also investing in the long-term success of your business.

Hospitalization Coverage

Hospitalization Coverage

Major medical insurance provides coverage for hospital stays, including surgeries, intensive care, and rehabilitation.

Doctor Visits

Doctor Visits

Routine check-ups, specialist visits, and other outpatient services are typically covered.

Preventative Care

Preventative Care

Many plans offer preventative services such as vaccinations, screenings, and wellness visits at no additional cost to the employee.

Prescription Drugs

Prescription Drugs

Most major medical plans include prescription drug coverage, helping employees manage the cost of their medications.

Major Medical Insurance FAQs

Q: What is major medical insurance?

A: Major medical insurance is a health insurance plan designed to cover significant medical expenses, including hospitalization, surgery, doctor visits, and prescription drugs.

Q: How can I determine the best major medical insurance plan for my employees?

A: Jackson Health Advisors will assess your company’s current plan, individual employer (and employee) needs, and budget to find the most suitable employee plan.

Q: Is major medical insurance required by law?

A: This depends on various factors, including the size of your business. Contact us to discuss your specific situation and compliance requirements.

employee plan.

Q: What is the cost of major medical insurance for small businesses?

A: Costs vary based on factors like employee demographics and coverage levels. We provide tailored quotes to meet your specific requirements and employee plan.

Q: How can major medical insurance benefit my business?

A: Providing major medical insurance can boost employee morale, productivity, and loyalty. It also serves as a competitive advantage in recruiting top talent.

Q: Can I customize my employee benefits package?

A: Absolutely! We specialize in creating customized packages to meet the unique needs of your business.

Ready to attract top talent and protect your business with comprehensive benefits?

Client Testimonials

“Jackson Health Advisors has been a game-changer for our small business. Their personalized service and comprehensive coverage have made managing our company’s employee benefits a breeze. And, there’s been no more complaints about lack of coverage. They found us an affordable plan that includes a large network of reputable care providers.”

Sarah D., Indianapolis

“Thanks to Jackson Health Advisors, we found an affordable employee benefits package that fits our budget and meets our needs. Beth found gaps in our policies, and, she switched us to a plan that met everyone’s needs and saved us thousands. The way she explained benefits and answered our questions, made everything so easy and digestible. Highly recommend!”

Mike D., Indianapolis

Share Your Feedback

Expanding Our Reach to Serve You

We are passionate about providing employee benefits in Indianapolis and the surrounding areas. Our local focus allows us to better understand and address the specific needs of our community.